Piekļuve globāliem akciju tirgiem bez komisijas

Investē tikai 1 EUR, tirgo no 100 EUR

Simtiem akciju un akciju CFD no dažādām pasaules biržām bez komisijas maksas! Piedāvājums attiecas uz Trade.MT4, Trade.MT5, Invest MT5 kontiem*.

Tirgo un ieguldi vairāk kā 8000 instrumentos jau šodien

Kā tas strādā

Reģistrējies

Reģistrējies ar savu vārdu un e-pasta adresi, lai sāktu tirdzniecību

Iemaksā līdzekļus

Sāc ieguldīt no €1, un sāc tirgot no €100

Sāc tirgot

Autorizējies un sāc vairāk kā 8000 instrumentu tirdzniecību!

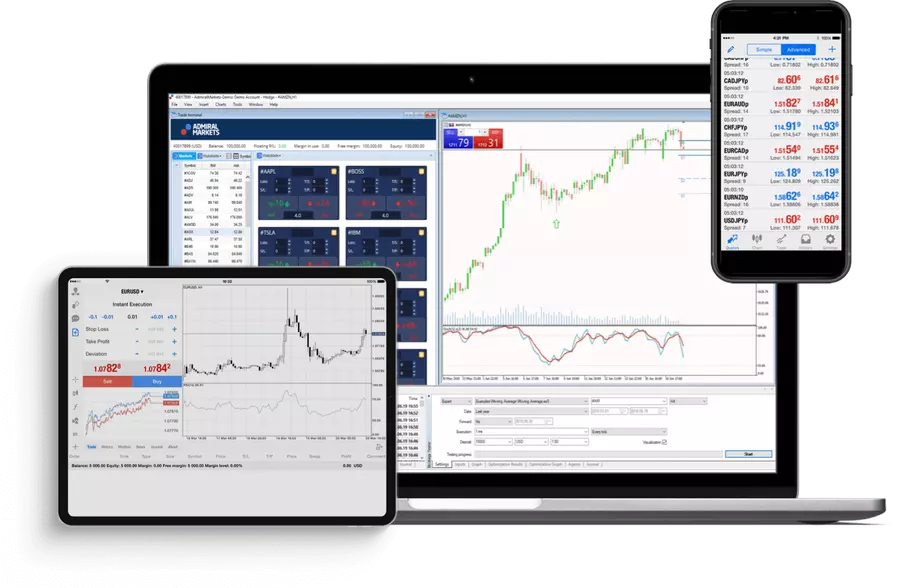

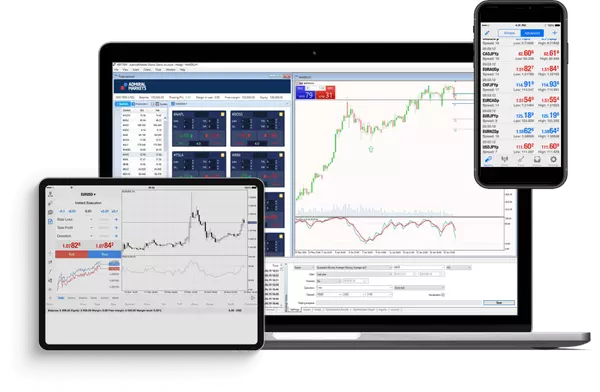

MetaTrader: #1 izvēle treideru un investoru vidū visā pasaulē

Trade or invest in 8,000+ trading instruments including Forex pairs, CFDs on indices, commodities, cryptocurrencies, shares, ETFs, and bonds, or purchase shares or exchange-traded funds. Available on both Windows and Mac.

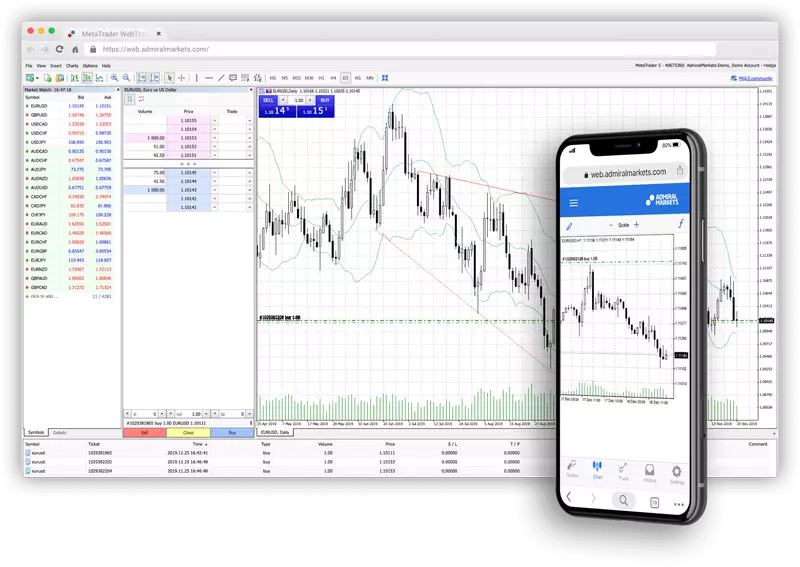

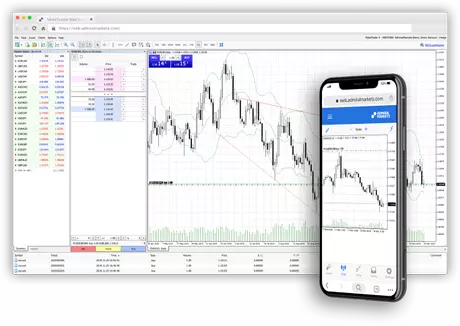

MetaTrader WebTrader programma

Tirgo no jebkuras vietas, jebkurā laikā, bez nepieciešamības lejupielādēt tirdzniecības programmu. Izmanto Mac vai PC un piekļūsti tirgiem ar interneta pārlūku un WebTrader tirdzniecības programmu.

MetaTrader: #1 izvēle treideru un investoru vidū visā pasaulē

Trade or invest in 8,000+ trading instruments including Forex pairs, CFDs on indices, commodities, cryptocurrencies, shares, ETFs, and bonds, or purchase shares or exchange-traded funds. Available on both Windows and Mac.

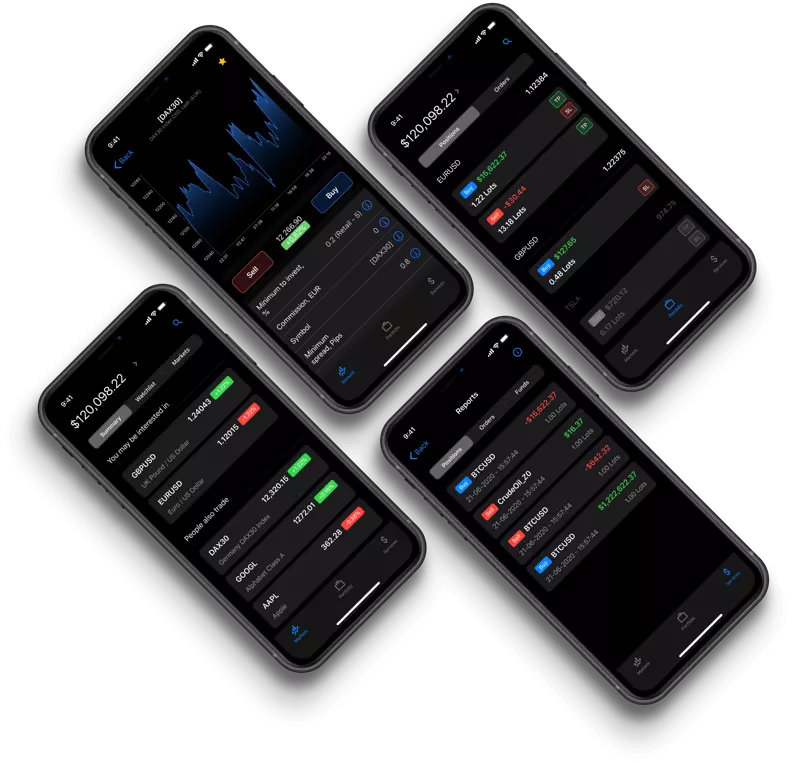

Tirgo ar Admirals mobilo aplikāciju

Veiciet tirdzniecību, atrodoties ceļā, izmantojot Admirals mobilo tirdzniecības lietotni! Jūs varat uzraudzīt tirgus, piekļūt grafikiem, atvērt un slēgt darījumus un daudz ko citu no sava sīkrīka. Pieejama iOS un Android operētājsistēmām.

MetaTrader WebTrader programma

Tirgo no jebkuras vietas, jebkurā laikā, bez nepieciešamības lejupielādēt tirdzniecības programmu. Izmanto Mac vai PC un piekļūsti tirgiem ar interneta pārlūku un WebTrader tirdzniecības programmu.

Labākie tirdzniecības nosacījumi

Tirgo ar labākajiem nosacījumiem šobrīd un saņem vienus no viskonkurētspējīgākajiem sprediem tirgū!

- Leverage 1:2 - 1:500

- Forex tipiskais spreds no 0.6 punktiem (EURUSD), mikro lotes un dalītās akcijas

- Akciju CFD bez komisijas maksas*

- Bezmaksas reāllaika grafiki, tirgus ziņas un izpēte

- Vairāk kā 4000 valūtu, energonesēju, metālu, indeksu, akciju un digitālo valūtu CFD

- Vairāk kā 4500 akciju un ETF

Kāpēc izvēlēties Admirals?

Ar pārstāvniecībām visā pasaulē

Saņem atbalstu vietējā valodā - mums ir 16 pārstāvniecības un nodrošinām klientu atbalstu vairākās valodās saziņā caur telefonu, e-pastu vai tiešsaistes rīku mājaslapā

Mēs esam uzraudzīti

Mēs esam saņēmuši licences no pasaules vadošajiem uzraugiem Lielbritānijā, Igaunijā, Kiprā un Austrālijā

Līdzekļi ir aizsargāti

Visi klientu līdzekļi tiek turēti atsevišķi no mūsu pašu līdzekļiem, turklāt mēs piedāvājam papildus aizsardzību augstas tirgus volatilitātes apstākļos

Sāc no €1

Jūs varat ieguldīt akcijās no €1 un sākt tirdzniecību no €100

Ar pārstāvniecībām visā pasaulē

Saņem atbalstu vietējā valodā - mums ir 16 pārstāvniecības un nodrošinām klientu atbalstu vairākās valodās saziņā caur telefonu, e-pastu vai tiešsaistes rīku mājaslapā

Mēs esam uzraudzīti

Mēs esam saņēmuši licences no pasaules vadošajiem uzraugiem Lielbritānijā, Igaunijā, Kiprā un Austrālijā

Līdzekļi ir aizsargāti

Visi klientu līdzekļi tiek turēti atsevišķi no mūsu pašu līdzekļiem, turklāt mēs piedāvājam papildus aizsardzību augstas tirgus volatilitātes apstākļos

Sāc no €1

Jūs varat ieguldīt akcijās no €1 un sākt tirdzniecību no €100

Izmēģini tirdzniecību demo kontā

Neesat pārliecināts, kā sākt? Mēs jums palīdzēsim! Sāciet praktizēt tirdzniecību ar virtuāliem līdzekļiem Admirals demo tirdzniecības kontā.

Bez stresa

Bez iemaksas

Bez kartes

Sazinies ar mums

Ir jautājumi? Sazinies ar mums šodien!